By DN Comply

Bitcoin is the most important invention to emerge so far this century. But it takes time to understand—its brilliance won’t dawn on you all at once. Bitcoin enthusiasts often say you need about a hundred hours of study to even begin to know what you’re talking about. That figure sounds right to me. I’ve put in more than a thousand hours, and I’m still only getting started.

Although it’s an endlessly deep topic, your first hour of study delivers the greatest return. One hour is all it takes to become acquainted with the basics. So I invite you to consider this piece as your first immersion into bitcoin. Here, I will introduce the most important points and construct a solid base for future learning. Along the way I’ll debunk some nonsense you’ve probably already been exposed to from major media. Bitcoin brings a great advance to society at a crucial moment in history. The sooner you start learning, the more you will benefit.

Learning about bitcoin is never a drag. Bitcoin is fucking cool. It’s the most fascinating technology I’ve ever encountered and digging further into Bitcoin is always rewarding. If you’re not awed by its genius and importance, you don’t yet understand bitcoin.

Because of the crazy variety of fields it intersects with and draws from (economics, computer science, game theory, etc.), I’ve always suspected it was introduced by extraterrestrials or benevolent AI. But enough with the crazytalk (or the sincerely-held belief), let’s dive in!

Welcome to the Orange Pill

I have two goals in writing this introduction. First, I want to acquaint you with the most essential information about bitcoin, and hopefully convince you to put in your hundred hours of study. Second, if you decide to buy some bitcoin, I want to keep you from getting fleeced. As we’re about to see, not only do journalists sow confusion about the topic, newcomers to bitcoin must also watch out for scammers.

The first lesson of bitcoin is that: everybody buys bitcoin at the price they deserve. Bitcoin is just sixteen years old, and only a few percent of the population have so far purchased this asset. So if you drop what you’re doing and study bitcoin now, you’ll have the chance to buy at prices far lower than when the masses come stampeding in. Mass adoption is only just starting, so it’s still early. With only 21 million bitcoins available for 8 billion people, if you snooze, you lose.

Bitcoin Misinformation

Consuming mainstream journalism about bitcoin is the perfect way to go from uninformed to misinformed. The main hindrance to understanding bitcoin is the torrent of misleading coverage written by journalists who haven’t put in their hundred hours of study. If you read bitcoin journalism without skepticism, your opinions will be mush and you won’t even know it.

This essay introduces key bitcoin concepts by using the best-known phrases and terms used by bitcoiners, which I’ll set in boldface. Here’s our first: Getting competently exposed to bitcoin is often called taking the orange pill, a reference to the red pill in “The Matrix,” which instantly shatters all malevolent fabrications about the nature of reality. Getting orange-pilled fundamentally restructures your understanding of what money is and how it works. And when your relationship to money changes, how you interact with society and the world changes as well. Learning about bitcoin really is that big of a deal.

Journalists consistently get even the most basic things about bitcoin wildly wrong. They particularly enjoy issuing solemn proclamations that bitcoin is dead. Here are a few:

- June 20, 2011: Forbes published an article headlined, “So, that’s the end of Bitcoin then,” back when each coin was trading at $13.85.

- Sept. 29, 2014: The Financial Times wrote: “We’re going to stick our neck out at this stage and call this the end of Bitcoin,” back when each coin was trading at $397.78.

- April 19, 2016: Yahoo Finance quoted Transferwise CEO Taavet Hinrikus saying: “Bitcoin, I think we can say, is dead. There is no traction, no one is using bitcoin. The bitcoin experiment, I think we can say, is over.” Bitcoin was then trading at $437.50.

- June 29, 2019: the New York Post published an article headlined: “Bitcoin not built to last, despite recent surge.” Bitcoin traded that day at $11,882.

Want some more examples? Here are another 477 bitcoin obituaries.

While the predictions of demise pile up, bitcoin gets stronger by the day. Bitcoin’s hashpower and node count are beyond the scope of this introduction, but they are the best measure of the network’s health. Both are constantly reaching new all-time highs.

When not penning obituaries, journalists enjoy parroting bad-faith FUD, asserting that bitcoin is profligate waster of energy. There are dozens of inane articles on the subject jam-packed with laughably inaccurate claims. For instance, here’s a Fortune Magazine piece asserting that just one bitcoin transaction consumes $100 worth of electricity. This Lyn Alden analysis expertly debunks these sorts of overblown energy claims.

As you can see, the maxim, “You can’t believe everything you read,” sums up the quality of mainstream journalism coverage concerning bitcoin.

Stacking Sats

Don’t you wish you had bought bitcoin in 2011, back when it was under $14 a coin? Bitcoin’s now up about 7000 times its 2011 price. Too bad you missed the boat.

But you probably never really missed the boat. Most people who purchased $14 coins soon sold for “big gains” at $20 or $30 or $40, thrilled they doubled or tripled their investment. It’s not human nature to hold winners long-term, and very few people can do it. The world is full of people who sold their bitcoin for a PlayStation when they could have held it a few years longer and bought a house.

Bitcoiners often use the words hodl, hodlers, and hodling (deliberate misspellings of “hold,” based on a drunken 2013 forum post), to signify long-term investors who refuse to sell at any price. These investors are typically so committed to bitcoin that they “stack sats.” Stacking is a term borrowed from precious metals enthusiasts that refers to investors who spend a portion of their monthly income, year in and year out, to amass an ever-growing stack of gold or silver. “Sats” here is short for satoshis, the smallest unit of bitcoin, which amounts to a hundred-millionth of a coin.

Since a satoshi is worth less than a penny, anybody with a positive monthly cash-flow can stack sats, whether it’s $7 or $7000 worth per month. Bitcoiners have a low time preference—they are confident that money put into sats today will one day be worth more than if it were held in stocks, dollars, real estate, or other assets. They believe that the market doesn’t yet have a clue about the true value of bitcoin. And, above all, they have the patience to wait however many years it takes for bitcoin’s price to reach its fair value.

When you stack sats over a period of months or years, you’re essentially dollar cost averaging into bitcoin, and this can prevent you from blowing your entire wad when Bitcoin is at an all-time high and about to descend into a lengthy bear market. Many bitcoin exchanges allow you to automatically purchase a fixed dollar amount of bitcoin on a daily, weekly, or monthly basis—there is no easier way to stack sats.

Bitcoin’s Volatility

Bitcoin has a lengthy history of extreme volatility. It has repeatedly spiked to unprecedented highs, and then collapsed to prices lower than most hodlers could ever anticipate. Worse, following each sharp decline, bitcoin usually trades sideways at these lows for a painfully long time (while new obituaries pile up). But then, at long last, and to the delight of every hodler, bitcoin’s history is to once again soar to new highs. As I write this, nobody who has ever hodled bitcoin for more than five years has remained underwater based on their entry price.

A smart guy who goes by the pseudonym, “Rational Root” makes a compelling case that bitcoin operates in four-year cycles that include a boom to all-time-highs followed by a brutal crash where bitcoin dives to sphincter-tightening lows. He’s created dozens of historical bitcoin price charts that support his thesis. This one, in particular, is worth staring at until it sinks in:

Financial models generally break over a sufficiently long period of time, and the models created by Rational Root could break tomorrow. But imagine what the price of bitcoin will be if the trend shown in the above chart continues for another decade.

You probably won’t be lucky enough to buy bitcoin at a multi-year low, but that may not matter if you have the discipline to hodl. Given bitcoin’s spectacular long-term upward performance, bitcoiners often repeat an adage popular among stock investors during the 1980 to 2019 debt-fueled bull-market: “time in the market beats timing the market.”

Put another way, enthusiasts jokingly say bitcoin features NGU technology, which stands for Number Go Up. And if you ignore the highs as irrational exuberance, the steady upward trend becomes obvious.

So even though you’re extremely unlikely to time your bitcoin purchases perfectly, investors who have hodled long-term have done remarkably well. Michael Saylor, one of bitcoin’s most brilliant advocates, regards anything less than a five-year investment in bitcoin as trading rather than investing. Unless you are a financial wizard with a deep understanding of markets, trading is a euphemism for gambling.

Despite its history of astounding price increases over the long-term, bitcoin very rarely hits an all-time high. So at any given moment, many investors are inevitably underwater. In 2013, for instance, many people bought in at more than $1000—and then watched bitcoin plunge to under $200 and then stay under $300 for about eighteen months. Those with the discipline to hodl ultimately saw the value of their bitcoin skyrocket. Bitcoin bear markets happen time and again, and every single time patient hodlers have come out far ahead. It’s no stretch to say that investing in bitcoin—rather than merely trading it—tends to reward discipline and build character.

Strong Stomachs Build Character

When I was exposed to Bitcoin at the end of 2014, it so happened I already knew the basics of macroeconomics, public key encryption, coding algorithms, Austrian vs. Keynesian economics, and game theory. My familiarity with these topics enabled me to recognize the unique properties of bitcoin much quicker than most people. As a result I was confident bitcoin would succeed, so I decided to invest heavily.

Since I didn’t have a family to support, and stood to one day inherit some money, I could afford to be aggressive. My initial bitcoin investment involved most of my net worth. And, of course, immediately after buying in, bitcoin’s price dropped 20 percent and stayed there for a year. But I didn’t care. I was never tempted to sell because my understanding of bitcoin gave me confidence that tens of millions of investors would one join the scramble for just 21 million coins.

At least half of investing is choosing prudent allocations for each asset you purchase. Never take on any investment risk that could put you or your family on the street. And only buy bitcoin to the extent you understand it. Your best course of action might therefore be to stop paying attention to other things for a while and to study bitcoin deeply.

My intuition, which, like everything else here, should not be taken as financial advice, is that bitcoin is about 15 percent likely to fail (failure would mean it breaks in some way, rendering all bitcoin worthless). If bitcoin doesn’t break, I think it will become a dominant worldwide store of wealth, and that the majority of people will convert some of their assets (stocks, bonds, cash, gold, and real estate) to bitcoin. That would be the start of what bitcoin enthusiasts call hyperbitcoinization.

If hyperbitcoinization happens, I expect the flood of money pouring into bitcoin to drive its price up fifty or even a hundredfold. Bitcoiners use the verb “moon,” to describe these best-case scenarios of bitcoin price appreciation. I believe the odds are that bitcoin will moon, but don’t take my word for it. Put in your hundred hours of study and decide for yourself.

Bitcoin is the Ultimate Asymmetric Bet

The greatest investment opportunity you can encounter is an asymmetric bet. These occur when the risk/reward ratio of a potential investment is skewed in a heavily favorable direction. For instance, if you ever have the chance to do a fair coin toss that pays ten dollars for heads—but only loses you one dollar for tails—take it, and bet big! These sorts of asymmetric bet opportunities come around exceedingly rarely. Vijay Boyapati’s essay, “The Bullish Case for Bitcoin” makes the case that bitcoin is the greatest asymmetric bet of our time.

The above essay, which Boyapti later expanded into a book, came out in 2018. Several subsequent developments have made me even more bullish about bitcoin:

- It’s not just people who are buying bitcoin anymore—corporations have also joined in. Companies are purchasing thousands of bitcoin to add to their treasuries.

- FASB’s stupid accounting rules regarding bitcoin have been revised so Generally Accepted Accounting Principles will no longer penalize companies that hold bitcoin.

- Several top financial companies, including Schwab, Fidelity, Nasdaq, BNY Mellon, and BlackRock have recently introduced bitcoin purchase and custody offerings to large institutional investors.

The on-ramps for the big money now exist, and it’s impossible to repeat too often that there are only 21 million coins to go around.

I believe the day will arrive when, out of nowhere, a large tech company like Apple or Microsoft smash-buys 10,000 bitcoin. Once that happens, we’re off to the races. A big purchase by a Fortune 100 company will kindle a firestorm of institutional investments, as companies at long last rush to shift a portion of their assets to bitcoin. This sudden cash influx will, in turn, trigger a supply shock, as demand for bitcoin rushes far ahead of coins available for sale.

ETFs and the Coming Supply Shock

Even hardcore bitcoiners rarely grasp the crucial role that ETFs will play in bringing about a supply shock, so let me explain what I foresee happening.

In January of 2024, the U.S. Securities and Exchange Commission approved the creation of nine Bitcoin ETFs (Exchange Traded Funds). Even if these ETFs never launched, I believe that a Bitcoin supply shock was already inevitable. But the existence of Bitcoin ETFs radically accelerates this timeline. To understand why, you need to understand the qualities that make ETFs so special as an investment vehicle. I regard Bitcoin as the most important financial innovation of the past hundred years, and you can make a strong case that ETFs are the period’s second most meaningful financial innovation.

The first ETF, the SPDR S&P 500, launched in 1993, and remains among the most popular. Anyone can purchase shares of this ETF through their brokerage account by using the SPY ticker, just as easily as if they were buying shares of Microsoft or Apple. Each share of the SPDR ETF gets you a smidgen of ownership of all 500 of the giant companies listed in Standard and Poor’s index. The convenience of being able to purchase such a diversified stock portfolio simply by investing in a single security, purchasable through any brokerage account, was an unprecedented innovation in investing (prior to ETFs investors used mutual funds to purchase diversified asset portfolios, but those are annoyingly expensive and cumbersome for reasons we need not delve into here.)

The SPDR ETF alone now has more than a half trillion dollars under management. Following SPDR’s launch, hundreds more ETFs covering everything from precious metals to tech stocks to real estate came to market. By packaging up hard-to-purchase assets in whatever quantity you need, ETFs offer unprecedented convenience. Suppose, for instance, you wanted to invest $40,000 in silver. Purchasing it physically might entail ordering bars online, and having an irate FedEx driver delivering small but suspiciously heavy boxes to your doorstep. By contrast, buying a silver ETF bypasses the security issues surrounding transporting and safely storing this metal, as well as the time-consuming task of one day selling it in person to a metals dealer.

Fees for ETFs are often remarkably low—SPDR, for instance, charges just 0.09 percent per year. So, for every $100,000 you invest, SPDR assesses annual fees of just $90.

ETFs eliminate various pain points particular to purchasing particular assets. For many investors, the inconvenience and technical challenges required to purchase and custody Bitcoin are deal breakers, whereas purchasing a Bitcoin ETF couldn’t be simpler for anyone with an online brokerage account. Bitcoin ETFs enable ownership of this asset without having to deal with any of these things:

- Purchasing and configuration one or more signing devices,

- Downloading, verification, and securely running node and wallet software.

- Generating a public/private key pair, and safely storing the signing devices and seedwords.

- Navigating the intrusive know-your-customer hassle of signing up with a bitcoin exchange.

- Moving your bitcoin off the exchange to the hardware wallet(s) you’ve set up.

Most of the world’s privately-held wealth is currently controlled by older people who lack the technical aptitude and the patience to complete any of the above steps. If they tried to manage self-custody, they’d likely fail and lose their bitcoin. Even people who succeed would likely find the stress not worth the tiny added cost of simply using an ETF.

In practical terms, a rich person with substantial assets in her brokerage account can now buy a million dollars of Bitcoin via an ETF in just a few minutes—no phone calls, wire transfers, or burdensome custody setups required.

Given all their advantages, it’s no surprise that billions of dollars are pouring into Bitcoin ETFs. The three largest ETFs now own about one million Bitcoin. You can check the latest performance of these ETFs using Apollo’s excellent ETF dashboard.

How Will Bitcoin ETFs Impact Price?

Anyone can audit the blockchain for details about every single bitcoin in existence. However, we have no way to know exactly how many of these bitcoins are in the hands of hodlers. I suspect at least 15 million bitcoins are either owned by hodlers or permanently lost. Meanwhile, ETFs will continue to gobble up tens of thousands of bitcoin a week.

You can think of the current crop of Bitcoin ETFs as nine fat straws dunked into a milkshake that was already running out. I can’t imagine it’ll be long before the supply shock hits, and I think its impact on prices will be more dramatic than what even optimistic Bitcoiners anticipate. Why? Because with any other commodity from gold to grain to oil, the price increases of a supply shock incentivize dramatic increases in production. With Bitcoin, 21 million coins is all there is, and there’s no way to mint more than that to accommodate a sharp burst in demand. New demand can only increase price, since the Bitcoin supply is capped.

I am emphatically not suggesting that ETF-held bitcoin is as good as properly self-custodied bitcoin—there are numerous ways the ETFs come up short. But the Bitcoin ETFs do enable multitudes of wealthy and less technically-skilled people to instantly purchase vast quantities of Bitcoin. The impact of these ETFs is only starting to be felt. Worldwide, more than a half million people each own at least $30 million dollars of assets. And now, a great many of them can gain exposure to Bitcoin within minutes, simply by logging into their brokerage account and buying a Bitcoin ETF.

How High Can Bitcoin Go?

Economic trends we’ll examine later in this essay seem to be hastening the world in the direction of hyperbitcoinization.

Greg Foss, who spent 35 years in a risk management chair where he was responsible for allocating billions of dollars, believes that institutional asset managers have no choice but to embrace bitcoin. Foss and other macroeconomic experts believe the world economy is breaking down, and while the details of how the collapse will play out cannot be known, he often says, “all roads lead to bitcoin.”

As more people purchase bitcoin, this simultaneously strengthens legitimacy while driving down the available supply. Bitcoin prices have a tendency to spike suddenly, driven by Fear of Missing Out (FOMO).

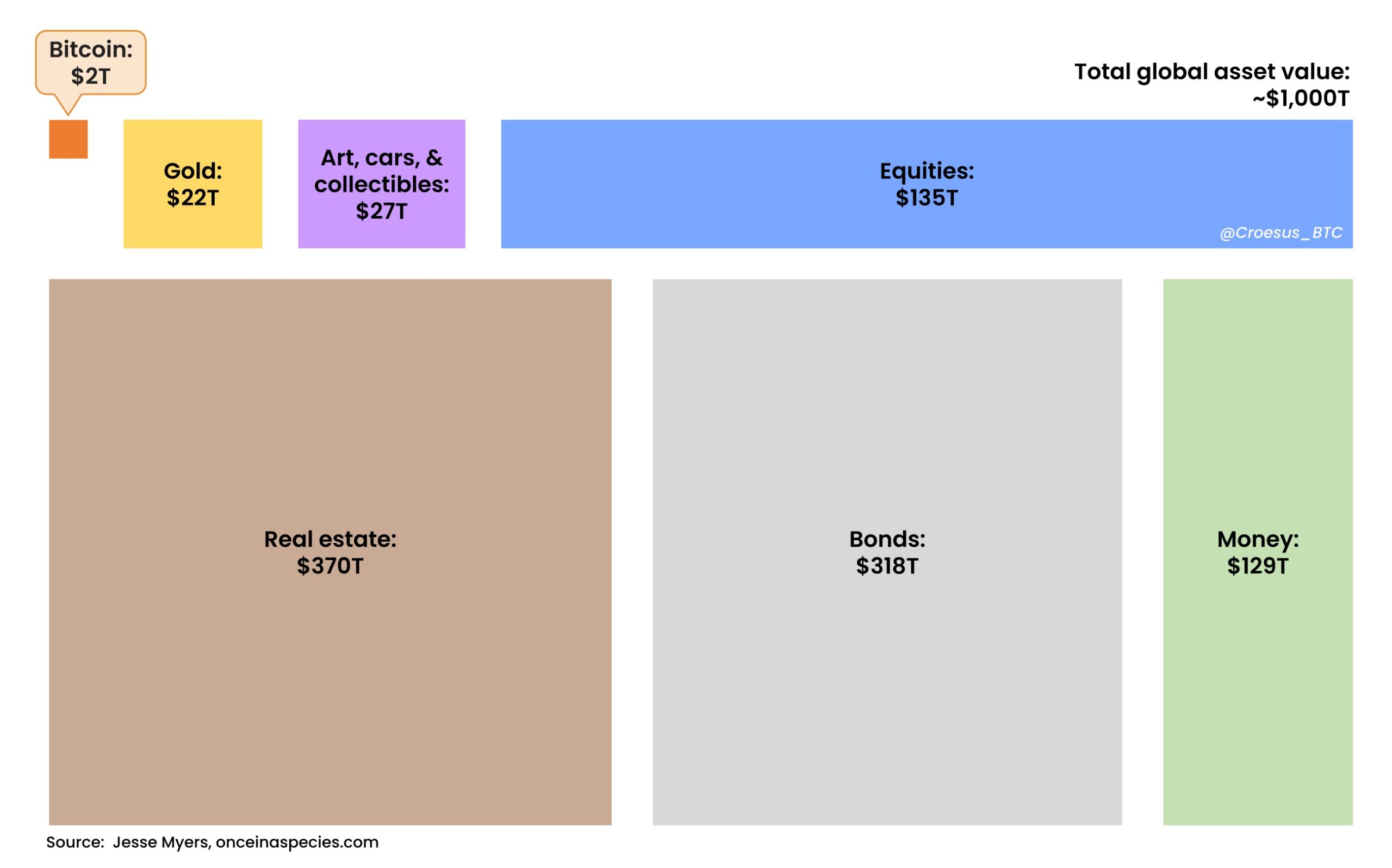

Foss has calculated that if just 5 percent of the world’s assets are sold in order to purchase bitcoin, each bitcoin will be worth in the neighborhood of two million dollars. Just like a black hole, hyperbitcoinization will suck in ever-increasing amounts of value from other asset classes.

Why Bitcoin Could Leapfrog Gold

On the road to hyperbitcoinization, gold will undoubtedly be the first major asset class surpassed by Bitcoin. That’s because gold is the smallest major asset class, and bitcoin is flat-out superior to gold as a store of value:

- Bitcoin is forever limited to 21 million coins, whereas gold miners expand the world’s inventory of gold by about 2 percent a year. So the longer you hold gold, the more your share of the world’s gold supply dilutes.

- You can’t cross borders with gold without significant expense and risk.

- Gold is inconvenient to sell. Buyers must assay it to avoid fraud. You’re also likely to pay several percent above spot price when buying gold, but only receive spot price—or a little less than that—when you sell.

- When you do sell gold, your sale is constrained by the size of your coins or bars. You can’t arbitrarily decide to sell exactly $3.12 of gold for coffee or $306,500 of gold for a house.

Given the overwhelming advantages bitcoin offers over gold, I believe the valuation of all the world’s bitcoin will one day surpass the value of all the world’s gold. As of June of 2025, bitcoin’s market capitalization is just over 2 trillion, whereas gold’s market cap is somewhere around $26 trillion. Bitcoin is so much better than gold, for so many reasons, that this leapfrogging may happen as abruptly as cellphones displaced landlines. And once that’s accomplished, I expect that bitcoin will continue pulling in value from other asset classes like stocks and real estate as hyperbitcoinization continues.

What Could Possibly Go Wrong?

Bitcoin’s success is not guaranteed. It could get damaged or destroyed by a state-level attack wielding massive resources. Alternatively, there may be an undetected flaw in bitcoin’s code that will cause it to collapse.

I nevertheless think that bitcoin offers extremely high potential reward in return for moderate risk. If you’re trying to determine the probability that bitcoin will fail, it’s worth considering the Lindy effect, which asserts that the longer something survives, the longer it’s likely to continue existing.

The Lindy effect says that if Bitcoin was going to collapse due to an attack or an unrecognized vulnerability, it most likely would have happened sooner rather than later. In other words, bitcoin was much more likely to collapse from 2010 to 2015 than it was from 2015 to 2020. Every year that goes by makes bitcoin’s demise less likely.

Bitcoiners often say, “Tic-toc, next block,” to reference the fact that every ten minutes or so the latest group of transactions is appended to the bitcoin blockchain. That means that with each new block successfully added to the chain, Bitcoin’s Lindy effect ratchets up another notch.

The Three Perils

Anyone contemplating purchasing bitcoin should avoid leverage, shitcoins, and affinity scams. Each has swallowed billions of dollars that could have been safely locked down into bitcoin. Let’s give these three hazards a quick look.

1) Leave Leverage to the Experts

As with stocks, many investors buy bitcoin using leverage. This is also known as buying on margin. Leverage enables you to buy more bitcoin than you have money to purchase, which is an incredible thing if the price of bitcoin does nothing but increase. At some point, you can liquidate a portion of your holdings, pay off the margin loan, and end up way ahead.

But if the price of your bitcoin drops sufficiently beneath your purchase price, you must put up more money immediately or else your entire holdings can be liquidated. That unpleasant moment is what’s known as a margin call. The greater your leverage, the less bitcoin needs to drop for you to face a margin call.

Bitcoin’s history of dropping far lower than anyone expects makes using leverage incredibly risky (read: stupid). As Caitlin Long says, “A fool and their leveraged bitcoin are soon parted.”

The world is full of people who bought bitcoin on leverage, maybe got temporarily rich as the price rocketed up, and then lost everything during the next downturn. In bitcoin vernacular, that’s called getting rekt.

It’s easy to avoid getting rekt if you simply follow privacy advocate Matt Odell’s admonition that he repeats on nearly every podcast appearance: “Stay humble and stack sats.” Even if you bet big on bitcoin, do it in a responsible way where you buy only what you can afford to lose, and then hodl your bitcoin long-term. Above all, shun leverage so you’ll never expose yourself to a margin call. Remember that the key to successful investing is to never bet money you can’t afford to lose.

2) Altcoins are Shitcoins

Since bitcoin is fundamentally nothing more than a computer program backing up its blockchain to thousands of nodes, anyone can modify a few lines of this program and thereby create an entirely new coin. In fact, it’s so easy to create your own coin that, at last count, there are more than 19,000 competitors to bitcoin. The creators of these coins call them altcoins, whereas bitcoiners rightfully call them shitcoins. Some of these coins even steal the bitcoin name in an effort to entice the gullible: there’s bitcoin cash, bitcoin Satoshi’s vision, bitcoin gold, bitcoin diamond, and assorted other ripoffs. They’re all fraudulently named and buying them gives you zero ownership of the real bitcoin.

The fact that even Bitcoin.com promotes and sells shitcoins underscores how vigilant you need to be when investing. I don’t have space here to explain why every altcoin is a shitcoin, so for the time being, please just take my word for it and don’t get suckered. As your understanding of bitcoin deepens, in your twentieth or thirtieth hour of study you’ll be ready to read a detailed explanation of why altcoins are a con game. But for now, just know that every altcoin shares one common characteristic: it was created by someone wanting you to hand over your bitcoin in exchange for a garbage coin that’s destined to collapse in value.

3) Beware Affinity Scams

No matter where you invest your money—whether it’s into bitcoin, bonds, or bowling alleys—it’s human nature to try to squeeze out a little more juice. Grifters are constantly looking to take advantage of this inclination in order to steal your money.

So be on the lookout for bitcoin affinity scams. As the name implies, they exploit your interest in bitcoin to hook you into a scheme that will steal your investment. These scams take two forms:

- Trade your bitcoin for an altcoin that generates yield.

- Transfer your bitcoin to a custodian and they’ll pay you interest on it.

Both paths lead to a rug pull—someone taking your bitcoin and never giving it back. These affinity scams are often hilariously obvious, such as the BitConnect Ponzi scheme that memorably imploded within a couple of weeks of this unforgettable promotional video.

Other times, you get more sophisticated and harder to detect Ponzinomics like those initiated by the Celsius Network, BlockFi, the Hex currency, or the FTX exchange. While I’m at it, the entire Ethereum ecosystem is a pseudo-decentralized dumpster fire run by fundamentally dishonest people, and don’t get me started about NFTs.

When you buy an altcoin, you’re really buying bitcoin for a scammer, and receiving in return a worthless token destined to collapse in price. So don’t think of Bitcoin as a cryptocurrency—think of Bitcoin as Bitcoin, and “crypto” as scams. As macroeconomics expert Lyn Alden says, “It’s about Bitcoin, not ‘crypto’. There’s a useful tech here, and a sea of scams built around it.”

Bitcoin was created by one or more geniuses under the pseudonym Satoshi Nakamoto, who anonymously gave the world an invention of immense importance and then disappeared. Altcoin creators, by contrast, build their empires on charisma, trickery, ersatz “community,” and the inevitable rug pull.

Not every bitcoiner is a true bitcoiner. Countless “influencers” spend 90 percent of their time talking about bitcoin, and 10 percent of their time shilling an altcoin or some Ponzi lending scheme. While the creators of this content may appear to be bitcoiners, in reality they’re feeding their audiences to the wolves. They’ll often have some entertaining and insightful thoughts, but their long game is to sell you on a scam that will make you part with your money or bitcoin.

How Do You Buy Bitcoin?

You can buy bitcoin from many places: friends, strangers, exchanges, and even PayPal, Robinhood, and Cashapp. That said, I personally wouldn’t touch PayPal or Robinhood with a barge-pole.

If at all possible, buy your bitcoin without submitting to Know Your Customer (KYC) data collection. You shouldn’t have to disclose your birthday, social security number, or home address to buy bitcoin, and you certainly shouldn’t have to scan your driver’s license. Over and over in the bitcoin world, exchanges get hacked and sensitive KYC data becomes public. Refusing to expose your personal information will keep you safe.

That’s why it’s best, whenever possible, to buy bitcoin from friends rather than from exchanges. You can also buy bitcoin from strangers by meeting at a coffee house, handing over your cash, and doing the transaction in person. But note that doing bitcoin transactions with strangers introduces risk, especially when purchases are large. Over the years, thieves have violently attacked dozens of hodlers to steal their bitcoin.

If you can’t buy bitcoin without KYC, at least buy it from a reputable company. I like Swan and River since they don’t traffic in shitcoins, nor do they offer leveraged trading. That shows integrity, and I avoid companies that compromise their ethics for short-term profits.

Self-Custody is Crucial

It’s tempting to simply leave your bitcoin in the custody of whichever exchange sold it to you. But until you move your bitcoin off the exchange you don’t really own it—all you truly own is an IOU. Leaving your bitcoin on an exchange introduces counterparty risk, which in this case involves the possibility of losing your bitcoin if your exchange gets hacked or collapses.

Exchanges get hacked all the time, and over the years thieves have made off with billions of dollars worth of assets. Sometimes the owners are refunded and made whole, but oftentimes they aren’t. Even in the best cases, people who do receive refunds often wait years in limbo to get their coins back. Astonishingly, if you keep your coins on an exchange or lending platform that goes belly-up, you will not be first in line to recover your bitcoin through bankruptcy courts—other creditors will have claims to your bitcoin that legally precede your own.

Every day you leave bitcoin on an exchange puts your precious coins at risk. And even if an exchange manages to hold your bitcoin securely, governments might introduce onerous new KYC requirements to sell or take custody of the bitcoin you’ve already purchased.

With the above in mind, one of the most oft-repeated phrases among bitcoiners is, “Not your keys, not your bitcoin.” Until you transfer your bitcoin to your own UTXOs using a signing device you control, your bitcoin doesn’t truly belong to you. Don’t become one of the thousands of people who’ve left their bitcoin on an exchange or lending platform, only to wake up one morning to find it gone.

Taking Custody of Your Bitcoin

Your many choices regarding bitcoin custody is an enormous topic that I can’t begin to cover properly here. So let me just say that as your bitcoin stash grows, you’ll want to use increasingly robust methods to lock down your bitcoin. If you only own a tiny amount of bitcoin, installing muun wallet on your smartphone is probably safe enough. Just keep your seed phrase in a very safe place, and don’t secure more bitcoin with your phone than you are willing to lose, or you may fall victim to a crypto mugging.

Substantial amounts of bitcoin are best locked down using a hardware-based signing device like a ColdCard, Ledger, or Blockstream Jade. Matt Odell recommends starting with a Coldcard combined with Sparrow Wallet, and backing up your seed phrase using a steel plate. He’s written this configuration guide. If your bitcoin holdings are worth more than a nice car, you are perhaps moving into the territory where you’ll want the added security of a multi-sig solution.

There are hundreds of ways to lock down your coins, so prepare to be overwhelmed by choice. Ben Perrin at Bitcoin Sessions has created dozens of videos taking you step-by-step through many ways to take custody of your coins. And this video interview of Stadicus, the product lead of the BitBox hardware wallet, offers an accessible overview of the key issues surrounding self-custody.

No matter how you self-custody your bitcoin, you need to think about physical security (keeping your devices, passcodes, and recovery keys safe) as well as obscurity (not letting potential attackers know you own bitcoin in the first place).

There is no one right method to secure your bitcoin. Custody is all about selecting intelligent trade-offs of security vs. convenience vs. technical aptitude. What’s wisest for me probably won’t be what’s best for you.

But there’s one solution that you should rule out: do not hire a custodian that charges you an annual percentage of your bitcoin holdings—that’s absurd. I view any bitcoiner who promotes those companies with suspicion. By all means, pay an annual fee for multi-key custody assistance if you need help, but never from a company that siphons off a percentage of your stack each year for simply holding one of your keys.

You can begin exploring how to lock down your bitcoin by reviewing this coverage.

Have Two or More Stashes of Bitcoin

Bitcoin’s “Not your keys, not your coins” ethos makes enormous sense. Unfortunately, many advanced bitcoiners don’t appreciate how much skill it requires ordinary people to safely take possession of their coins. You currently need considerable technical ability to properly set up a signing device and transfer coins, especially if you’re using sophisticated privacy and multi-sig tools.

New advancements are making bitcoin custody easier. But if you have an older relative who is always losing her Gmail password or who thinks Facebook is the Internet, you’ll instantly realize that they’ll never have the technical ability to configure a bitcoin node or a signing device.

I happen to be more technical than most people. But I freely admit that the most likely way I’ll lose my bitcoin is not from a thief, but from my own incompetence.

As you explore different forms of self-custody, never forget that bitcoin is not a company, it’s a protocol. No customer service department exists. You can’t speak to the manager because decentralized protocols don’t have a manager. So your bitcoin is probably gone forever if you mismanage your keys, lose your hardware wallet’s PIN, or send your bitcoin to the wrong address. The same qualities that make properly-secured bitcoin unhackable can also make it unrecoverable if you screw up. As Preston Pysh says, “Welcome to the land of absolute personal responsibility.”

That’s why, since I own a substantial amount of bitcoin, I keep it in separate stashes. That way, if something goes catastrophically wrong despite all my precautions, I won’t lose all my bitcoin.

I’ve put most of my bitcoin into cold storage using five different signing devices distributed thousands of kilometers apart, with any three of these keys required to move my bitcoin. But I also hold a separate stash that I acquired by purchasing stock in a 30-year-old company that owns more than 550,000 bitcoin. For that tranche of my bitcoin exposure, I’m admittedly introducing counterparty and leverage risks, but I’m convinced this company is ethically run and self-custodies its coins with even greater care than I do. And all I have to do to keep that part of my bitcoin stockpile secure is to use a good password manager on my online brokerage account.

So, What is Bitcoin Anyway?

One reason people don’t intuitively understand Bitcoin is that they can’t see or touch it. Bitcoin is often represented online as a cartoon orange coin, or as a minted gold coin, but that’s because our brains aren’t wired to grasp things lacking physical shape or form. Yet just like streaming services such as Spotify and YouTube rendered CDs and DVDs obsolete, bitcoin does the same to physical money.

Since you can’t see or hold it, when you buy bitcoin, what exactly are you getting? Where is your bitcoin, how can you prove you have it, and most importantly, how do you spend it?

Fundamentally, bitcoin exists on a public ledger that anyone can download. This ledger tracks the ownership of all 21 million bitcoins, with each coin divisible into 100 million satoshis. Solid state storage has become so cheap that a $60 microSD card can store every single bitcoin transaction that’s ever occurred. Volunteers presently maintain more than 20,000 nodes worldwide, each storing a copy of Bitcoin’s public ledger. Roughly every ten minutes, each node on the network gets updated with the latest batch of transactions.

Anyone can move or sell their bitcoin by signing a transaction with their private key, then paying a small fee (in bitcoin, of course) to have a miner validate the transfer. The protocol checks whether the owner has sufficient bitcoin for the transaction, and, if so, it approves the transfer by writing it to the public ledger.

Bitcoin is Uncensorable, Non-Confiscatable Money

One of bitcoin’s great virtues is its censorship resistance. Censorship usually refers to the suppression of certain forms of speech, but government officials are just as eager to dictate how you can spend your money. During the Canadian trucker protests, the GoFundMe platform backed out of its commitment to distribute donations to the truckers. Days later, Canada’s government went on to freeze hundreds of bank accounts from people who donated.

You don’t have to be a fan of the truckers to find Canada’s heavy-handed response alarming. Trucker supporters turned to bitcoin to bypass traditional payment channels and successfully sent hundreds of thousands of dollars.

Even worse than being forbidden to spend your money however you please is having that money taken from you without cause. Both cash and gold are easily seized by law enforcement, often under abusive pretexts called civil forfeiture. These laws allow the police to keep your money even if they never charge you with a crime.

Try carrying a large amount of cash or gold when crossing a border and you risk interrogation and confiscation. Since bitcoin exists purely on the network’s public ledger, it follows you wherever you go, yet you never carry it on your person. Bitcoin makes moving money between countries safe and reliable, rendering intrusive border agents powerless. Of course, I wouldn’t carry along a configured signing device or my seed phrase when crossing a border, but there are all sorts of ways to safely access your bitcoin, no matter which country you visit.

Bitcoin is, therefore, ideal for refugees fleeing persecution, as well as anyone residing in a country experiencing a banking crisis. It’s also perfect for foreign workers sending remittances to family at home. Bitcoin transaction fees, particularly those done over the lightning network, are so tiny that Western Union is a dead company walking, just like CompuServe was doomed by the emergence of SMS email and the World Wide Web.

Government gains power whenever you use its official currency. You gain power when you save and purchase using bitcoin. Bitcoin is the people’s money, and whenever it’s used, liberty is enhanced.

Fiat Currency and Inflation

Beyond its vulnerabilities to censorship and confiscation, government currency is a terrible way to store wealth since it’s subject to constant inflation.

Economists call government-issued money, “fiat currency.” The cause of the fiat currency’s inflationary tendencies is revealed by the word itself: “fiat” is Latin for “Let there be…” Fiat currencies grant governments the god-like ability to create money out of thin air—as much as they want, whenever they want. Inflation isn’t just something that spontaneously happens. It’s the logical outcome of debasing the currency through money printing. Bitcoiners often correctly say: “inflation is theft.”

Nico ZM, the co-host of the Simply Bitcoin podcast, makes the point beautifully: “Bitcoiners fundamentally believe that nobody should have the ability to create money for free that somebody else has to work for.”

Why hold your savings in a currency certain to lose purchasing power, when Bitcoin will likely increase in value when held long-term? Fiat currency is intrinsically inflationary, whereas Bitcoin is fundamentally deflationary. In other words, dollars and other government currencies lose value the longer you hold them, whereas (as growing numbers of people chase a fixed number of coins) bitcoin tends to gain purchasing power—often dramatically—when held over the long-term.

What’s Behind Recent Monetary Inflation?

For decades, the U.S. dollar possessed substantial resistance to inflation because it was directly backed by precious metals. In fact, dollars printed prior to 1966 actually carried the words, “Silver Certificate” on their frontsides. Anyone could take their $20 bill to a Federal bank and exchange it for silver. Likewise, all United States mint coinage worth ten cents or more once contained 90 percent silver. Starting in 1965, these coins were switched to mostly copper. Then, in 1971, President Richard Nixon closed the gold window, so international investors couldn’t redeem the dollar for gold either.

The upshot of all this is that, starting in 1966, dollar bills began carrying the words, “Federal Reserve Note,” instead of “Silver Reserve Note.” Critics correctly point out that the Federal Reserve (commonly referred to as, “the Fed”) is neither federal nor a reserve. There is no longer any reserve of precious metals backing the dollar, and the entity in charge of issuing dollars isn’t even federally owned. The federal reserve is actually a private corporation (albeit with the chairman appointed by the U.S. President). No restrictions exist to keep the Federal Reserve from issuing however many new dollars suit its purposes.

The people running the Fed are invariably Keynesian economists. Keynesian theory advocates interest rate reductions and money printing anytime the country enters a recession. And if there’s one thing the Federal Reserve has proven itself great at, it’s printing money. Here is a chart of the M2 dollar supply over the past forty years:

Notice that America’s money printing got completely out of control in 2020, at the start of the COVID pandemic. Predictably, this pandemic-inspired run of money printing kicked off severe inflation.

Although high in the USA, inflation is even worse internationally. Governments worldwide are printing money to pay their soaring debts and simultaneously weaken their currencies in order to boost exports. Global competitions to debase national currencies never end well.

As the world’s governments continue to print massive quantities of money, many fiat currencies are in a tailspin. We’ve recently witnessed currency collapses in Venezuela, Lebanon, and Turkey. And there are now strong indications that the yen, euro, and pound are likewise heading down the toilet.

Adam Fergusson’s When Money Dies recounts Germany’s runaway inflation of the early 1920s. Anyone reading Fergusson’s book will notice remarkably similar events playing out today. In the past, victims of hyperinflation had nowhere to turn, and they commonly had much of their life savings wiped out overnight. Thankfully, today we have Bitcoin, which is engineered to be a fixed expression of scarcity that anyone can purchase. We can protect ourselves from encroaching hyperinflation by cutting back on our reliance on fiat and by backing the adoption of bitcoin.

The Virtue of a Fixed Monetary Supply

Who knows how many dollars, euros, or yen will exist by next year, let alone in ten or twenty years? Bitcoin, by contrast, is forever capped at 21 million coins. Buy and hodl bitcoin today and your share of the world’s bitcoin supply will remain constant for the next decade, century, and millennium.

So how do we define these 21 million virtual coins? Since bitcoin is an entirely new type of asset, existing asset categories only loosely overlap with bitcoin’s true nature. Some people consider bitcoin digital gold. The IRS says bitcoin should be treated as property. And Gary Gensler, former chair of the SEC, maintained that bitcoin is a commodity.

However it’s classified, I think bitcoin is best regarded as a long-term store of value.

Unit of Account

When I was a kid, my elementary school taught the imperial system of weights and measures. Given the metric system’s obvious superiority, I not only took the time to learn it, but also to make it the default system I think in. It bugs me that new cars in the United States still come equipped with mile-based speedometers and odometers, as this unit of measurement is clearly inferior.

In the same way, pretty much everyone today measures value in terms of fiat, which is akin to using a measuring stick that’s constantly shrinking at different rates for different currencies. I therefore urge you to begin shifting your default financial measuring stick from fiat to bitcoin. In financial terminology, that’s called making bitcoin your unit of account.

One bitcoin will forever equal one bitcoin. Just divide your bitcoin holdings by 21 million and you’ll always know your exact share of the world’s supply. I believe that in a decade or two, most people will measure their net worth in terms of bitcoin. That is, they’ll not only own bitcoin, but they’ll mentally convert the valuations of their house, stocks and bonds to bitcoin.

If you don’t choose your unit of account, your unit of account chooses you. Neil Peart put it best: “If you choose not to decide, you still have made a choice.”

Thinking in fiat means you are trusting the powers that be to keep your best interests at heart. And that, in turn, means you’re a sheep, and you know what happens to sheep.

Debt Spirals, Debasement, and Default

After decades of spending well beyond their means, it appears that the United States and much of the rest of the world have entered a Debt Spiral, which James Lavish expertly describes here. Governments confronting a debt spiral can either default on their loans and thereby induce financial contagion and panic, or they can pay their debts using truckloads of freshly-printed money—thereby causing steep inflation.

For the past fifty years, common and prudent investment advice recommended a portfolio comprising 60 percent stocks and 40 percent bonds. This portfolio has done remarkably well since the 1980s, but now thanks to the debt spiral, as well as asset over-valuation brought on by decades of money-printing, it’s likely that bonds and stocks have entered an era of poor performance and great risk.

But that’s far from the only reason to buy bitcoin using wealth pulled out of your fiat-based assets.

The Coming CBDCs Surveillance Regime

When fiat currencies fail, they unravel in unpredictable ways that stem from the whims of whoever is in power. Here are a few examples of why holding fiat, either at a bank or under your mattress, is riskier than commonly understood:

- In 2016 India’s government abruptly declared all 500 and 1000 rupee bills invalid. People had to drop whatever they were doing and stand in long lines to convert their money. If you were sick or elderly, too bad—you needed to stand outside in the brutal heat for hours or lose your savings.

- Argentina went into default and hyperinflation six different times over the past century. Each occurrence saw steep overnight currency devaluations that left people waking up the next day missing a big chunk of their life savings.

- During the summer and fall of 2022, Lebanon’s banks sharply limited withdrawal limits from customer accounts. Desperate customers responded by organizing a depositor movement that carried out armed bank raids to recover the money they were owed. Then, on February 1, 2023, the government devalued its currency by 90 percent overnight.

Responses to currency collapses are about to become far more sinister. The very same governments that overspent for decades, thus rendering themselves insolvent, intend to coerce their citizens to surrender their freedoms in order to use their next generation of money. This money is called Central Bank Digital Currencies (CBDCs).

CBDCs are surveillance-oriented by nature, tracking your identity and every financial transaction you make. Worse yet, they enable unprecedented government control of your money. Governments can program CBDCs to prevent you from spending them in certain ways, or to become void if not spent by a certain date. James Lavish warns that:

CBDCs give the government the power to: change your money, restrict your money, take your money, or if they really want to, just turn it off completely.

Anyone who values freedom must therefore reject CBDCs, especially CBDCs handed out for free in exchange for signing up. CBDCs swallow personal freedom, and put entire populations a half-step away from enslavement under a Chinese-style social credit system. The Black Mirror series portrayed this near-term dystopia better than anyone.

In bypassing fiat, bitcoin provides us with the means to subvert the impending rollout of CBDC tyranny. So consider bitcoin a lifeboat. As with real-world lifeboats, the sooner you board your bitcoin lifeboat, the better.

Bitcoin is Coming for Fiat

Governments consistently spend beyond their means on wars and other boondoggles, then print money to pay for it. When their fiat currencies inevitably collapse, they come up with all sorts of justifications to confiscate assets. Franklin Roosevelt’s Executive Order 6102 is the most famous such example in American history.

In 1984, Friedrich A. Hayek prophetically anticipated the creation of bitcoin by saying:

I don’t believe we shall ever have a good money again before we take the thing out of the hands of government, that is, we can’t take it violently out of the hands of government, all we can do is by some sly roundabout way introduce something that they can’t stop.

Separating money from state offers as crucial an advance to liberty today as did separating church from state centuries ago. In bypassing the government’s control of money, bitcoin knocks out the cornerstone of the surveillance state.

Get Off Zero

I can’t offer advice on how much bitcoin you should own. All I can say is that I think owning zero bitcoin is a terrible mistake. To own no bitcoin is to put all your eggs in the fiat basket.

World banks are in the process of demonstrating that, as Max Keiser famously says, “you cannot taper a Ponzi.” As national economies get sucked further into the debt spiral’s vortex, the sharp declines recently witnessed in stocks, bonds, and real estate are likely to continue—and those prices are measured by fiat currencies which are themselves devaluing.

One way to regard bitcoin is not as a growth-oriented investment, but rather as insurance against the monetary system’s failure. Just as fire insurance protects your home, hodling some bitcoin insures against the fiat-based risk carried by the rest of your portfolio.

Beyond its use as insurance, bitcoin may turn into an excellent long-term investment in its own right. Whether this week’s bitcoin’s price goes up or down, every week sees more of bitcoin’s 21 million supply soaked up by hodlers. The pool of Bitcoin available for sale may, therefore, inevitably become increasingly shallow until the inevitable supply shock.

Bitcoin Math (How Much Bitcoin Should I Buy?)

Bitcoin’s most fundamental quality is that there will only ever be 21 million coins. Knowing that the total amount of bitcoin is frozen in perpetuity allows us to easily calculate our personal territory on the bitcoin blockchain. A little simple arithmetic can therefore help you decide how much to buy. Here’s an especially helpful increment to keep in mind:

21 million divided by 8 billion

This is the total supply of bitcoin divided by the approximate world population. Do the math and we get about 250,000 satoshis (0.0025 bitcoin), which represents one person’s share of the world’s total bitcoin supply. I’ve rounded down here but also not counted the millions of lost bitcoin, so if you purchase 250,000 satoshis you can be confident you’ve locked down at least one person’s share of the world’s bitcoin supply.

By extension, buying 2.5 million satoshis gets you ten persons’ worth of bitcoin, and 25 million satoshis (a quarter of a bitcoin) gets you a hundred persons’ worth of bitcoin. That’s why if bitcoin becomes a leading asset class (comparable to dollars, gold, or real estate), you won’t need to own an entire bitcoin to have amassed substantial wealth.

At the moment (early May, 2025), you can purchase 250,000 satoshis for just under $250 USD. By contrast, your share of the world’s gold supply costs more than $3300 (there are an estimated eight billion ounces of gold existing as coins, bars, and jewelry, so your share of the world’s gold costs roughly the price of one ounce). That’s a crazy ratio in favor of gold that I expect to reverse, given bitcoin’s clear superiority as a monetary asset.

Purchasing bitcoin in multiples of 250,000 satoshis will enable you to acquire vastly more bitcoin than most people can ever own. That, in turn, will cement your long-term wealth if we see anything approaching hyperbitcoinization.

Reviewing What We’ve Covered

I’ve thrown a lot of information at you, so before we get out of here, let’s recap some crucial points:

- When buying bitcoin, commit to hodling it for at least five years, and ideally more than a decade.

- Never forget that bitcoin could conceivably break or suffer an attack that collapses its value to zero.

- As long as you can afford a total loss, consider buying at least 250,000 satoshis (0.0025 bitcoin). If you decide to make a substantial bitcoin investment, think in multiples of 250,000 satoshis.

- Setting up an automatic weekly or monthly bitcoin purchase allows you to stack sats through dollar cost averaging, and can thereby decrease your overall cost basis should the price of bitcoin precipitously drop.

- Hodl bitcoin long-term and you will suffer through at least one lengthy bear market. Enjoy a nice cold glass of lemonade, knowing that 1 bitcoin always equals 1 bitcoin, and watch the people who’ve bought using leverage get rekt.

- Never keep your bitcoin on an exchange. Review your self-custody options and take control of your bitcoin. If you own a lot of bitcoin, keep it in at least two different stashes using different methods of security.

- Remember that obscurity is a crucial component of security. Telling people you own bitcoin exposes you to the proverbial $5 wrench attack.

Your Next 99 Hours

You can never fully understand bitcoin, but you can deeply understand parts of it. People with different areas of expertise gain mastery of different components. Bitcoin is an ongoing conversation among the world’s top financial experts, coders, and freedom enthusiasts. I pay attention to more than a hundred of these people through Bitcoin Twitter and I get so much out of their incredible diversity of expertise. It’s thrilling to deepen your understanding of how the different components of bitcoin fit together!

Twitter is the place to keep up with the very best bitcoin-related thoughts and developments. To get you started, here are five of the best and most high-integrity accounts drawing from different areas of expertise:

- Lyn Alden: Nobody covers bitcoin-oriented macroeconomic topics in greater depth, nor as eloquently.

- Michael Saylor: Bitcoin’s greatest hodler, and hyper-articulate.

- Matt Odell: Impeccably principled and technically savvy coverage focused on bitcoin and privacy.

- Cory Klippsten: Absolutely fearless when it comes to calling out scams and scammers. He’s kept countless people from losing their life savings.

- Lawrence Lepard: Offers expert yet plainspoken jargon-free explanations of how Bitcoin fits into the greater economic picture.

The bitcoin landscape changes every day, and there’s no better way to follow the latest happenings than through Bitcoin Twitter. For whatever reason, Twitter has emerged as the dominant platform for bitcoin news, opinion, and arguments. Nearly every whale and pleb worthy of attention uses Twitter to share their thoughts and ideas. If you follow these people and spend 20 minutes a day dipping into their latest tweets, your understanding of bitcoin will continually deepen.

Since there’s so much signal, you should be intolerant to noise. Be selective about which accounts you follow, and unfollow anyone who advocates shitcoins or lending out your bitcoin. For impeccably curated no-nonsense information, see the Bitcoin Resources page by Gigi.

I consider it imperative that we each do our part to inform the public about the virtues of bitcoin. The alternative is to invite financial calamity, and to give dark authoritarian forces the time to amass and destroy bitcoin. In my own little way, I took a month off to write this introduction in order to hasten bitcoin adoption. I hope it has helped you to get your bearings, and inspired you to commit to undertaking another 99 hours of study.

Note: Nothing here should be interpreted as offering investment advice, as I have no education on the topic outside of a semester of macroeconomics and a semester of accounting, neither of which I aced. I’m a dilettante with appalling gaps in my knowledge of everything having to do with money. Do not listen to me about anything.

All references to bitcoin and gold reference market values as of this article’s revision in May 2025.

Disclosure: I own bitcoin, shares of MicroStrategy (MSTR), and I once stupidly bought Litecoin. I bought the Litecoin in 2017 and later ditched it at a loss, and would never buy another shitcoin. Lesson learned.

If this article helped you, I hope you will make a point of sharing it via email and your social media channels. Thanksbye from D.N. Comply.